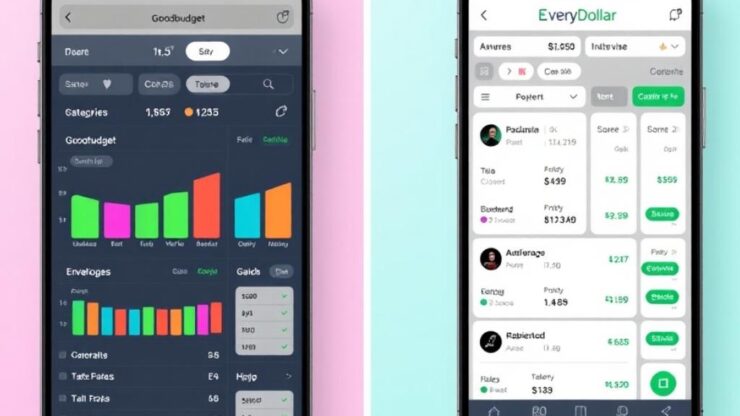

Overview of Goodbudget and EveryDollar

Goodbudget is a cloud-based envelope budgeting app that allows users to manage their finances by assigning portions of their income to specific spending categories. This method mimics the traditional envelope budgeting system but offers the convenience of digital tracking. Users can create virtual envelopes for various expenses, set spending limits, and track their progress in real time. Goodbudget is particularly appealing for those who prefer a structured approach to budgeting without the need for cash.

EveryDollar, developed by financial expert Ramsey Solutions, offers a straightforward budgeting tool that emphasizes simplicity and efficiency. It allows users to create a monthly budget in a matter of minutes, making it ideal for those who need a quick and easy way to manage their finances. EveryDollar’s zero-based budgeting approach ensures that every dollar is assigned a purpose, which can lead to better financial discipline and awareness. The app also integrates with bank accounts for automatic transaction tracking, although this feature is only available in the paid version.

When choosing between Goodbudget and EveryDollar, users should consider their individual budgeting needs, preferences, and financial goals. Below is a comparative overview highlighting the key features and differences between these two popular budgeting applications:

| Feature | Goodbudget | EveryDollar |

|---|---|---|

| Budgeting Method | Envelope budgeting | Zero-based budgeting |

| Platform | Web and mobile app | Web and mobile app |

| Cost | Free with limited features; premium version available | Free with limited features; premium version available |

| Transaction Tracking | Manual entry or import | Automatic syncing with bank accounts (premium only) |

| Financial Goals | Goal setting for envelopes | Goal setting for budgets |

Both Goodbudget and EveryDollar offer valuable budgeting solutions, but their distinct methods and features cater to different financial management styles. Users should evaluate their preferences for manual versus automatic tracking, as well as their comfort with traditional versus modern budgeting approaches, to make the best choice for their financial journey.

Features Comparison of Goodbudget and EveryDollar

When it comes to managing personal finances, the choice of budgeting apps can significantly impact one’s ability to achieve financial goals. Both Goodbudget and EveryDollar bring unique features to the table, catering to different preferences and styles. In this section, we will explore the specific features of each app, providing you with a comprehensive comparison to help you make an informed decision.

Goodbudget utilizes the envelope budgeting method, which allows users to allocate specific amounts of their income to different spending categories, much like the traditional cash envelope system. This visual approach can help users better understand where their money is going. In contrast, EveryDollar adopts a zero-based budgeting method, which ensures that every dollar is assigned a job, promoting financial discipline. The user interfaces of both apps are designed to be intuitive, but they cater to different user experiences. Goodbudget’s interface is structured around envelopes, while EveryDollar presents a straightforward list of budget items.

Tracking expenses is crucial for effective budgeting. Goodbudget requires users to manually input their transactions or import them from bank statements. This method encourages users to engage actively with their finances. Conversely, EveryDollar offers automatic syncing with bank accounts in its premium version, providing users with real-time updates about their spending without the need for manual entry. Additionally, both platforms provide reporting features that allow users to visualize their spending patterns and adjust their budgets accordingly.

Setting financial goals is an essential part of any budgeting strategy. Goodbudget enables users to set specific goals for each envelope, allowing for targeted savings. EveryDollar also facilitates goal setting but does so in the context of a broader budget framework, ensuring users keep their overall financial goals in perspective. Both applications encourage users to be proactive in their financial planning, but they approach goal setting in slightly different ways.

Below is a summary of the key features of Goodbudget and EveryDollar:

- Goodbudget: Envelope budgeting method, manual transaction tracking, customizable envelopes for goal setting, web and mobile accessibility.

- EveryDollar: Zero-based budgeting method, automatic transaction syncing (premium), straightforward list interface, goal setting within a budget framework.

Ultimately, the choice between Goodbudget and EveryDollar will depend on your personal preferences regarding budgeting method and tracking capabilities. Understanding the features of each app will empower you to select the one that aligns best with your financial management style.

User Experience and Interface Analysis

When it comes to managing finances, the user experience and interface of budgeting apps play a crucial role in ensuring that users can effectively engage with their financial goals. Both Goodbudget and EveryDollar have been designed with distinct user interfaces that cater to different preferences, making it essential to analyze how each platform provides an enjoyable and efficient budgeting experience.

Goodbudget stands out with its unique envelope budgeting approach. The interface is structured around the concept of virtual envelopes, allowing users to easily allocate funds to specific categories. This visual representation of finances can be particularly appealing, as it gives users a clear understanding of their spending limits. The layout is intuitive; users can swipe through envelopes, set limits, and visually track their progress. However, it’s important to note that the manual transaction entry can sometimes feel tedious for users accustomed to automated solutions. This requirement encourages a hands-on approach to budgeting, fostering a deeper connection between users and their financial habits.

On the other hand, EveryDollar embraces a more minimalist design with its zero-based budgeting method. The straightforward interface allows users to create a detailed budget quickly, assigning every dollar a specific purpose. This simplicity is a significant draw for those who prefer an efficient and uncluttered approach to budgeting. For premium users, the automatic syncing feature seamlessly integrates bank transactions, providing real-time updates that eliminate the need for manual entries. This functionality is a game-changer for busy individuals seeking to maintain awareness of their finances without the hassle of constant input. The overall design fosters a sense of clarity and ease, encouraging users to engage with their budget regularly.

Ultimately, the choice between Goodbudget and EveryDollar comes down to personal preference regarding user experience. Goodbudget appeals to those who thrive on visual organization and detailed manual tracking, while EveryDollar caters to users who favor efficiency and automation. Understanding these dynamics can empower individuals to select the app that best aligns with their financial management style.

Pricing and Subscription Models

When selecting a budgeting app, understanding the financial commitments involved is paramount. Both Goodbudget and EveryDollar offer distinct pricing structures that cater to diverse user needs, ensuring that individuals can find a plan that aligns with their budgeting habits. While both apps provide free versions, users often wonder how the premium options enhance their budgeting experience and whether the investment is justified.

Goodbudget operates on a freemium model, allowing users to access essential features without incurring any costs. The free version includes a limited number of envelopes and the ability to track spending manually. For users seeking a more comprehensive experience, Goodbudget offers a premium subscription that unlocks additional envelopes and advanced features such as syncing across multiple devices. The affordability of the premium tier makes it an attractive option for individuals who appreciate the envelope budgeting method but require more flexibility and capacity in their financial management.

EveryDollar also follows a freemium approach, granting users access to basic budgeting tools at no charge. However, the real value emerges with the premium version, which introduces automatic transaction syncing with bank accounts, a feature that significantly streamlines the budgeting process. This convenience appeals particularly to those who lead busy lives and prefer automated tracking. The premium subscription is competitively priced, considering the time saved and the enhanced functionality it provides. Users can enjoy the simplicity of zero-based budgeting while leveraging the power of real-time updates without the hassle of manual entries.

Both Goodbudget and EveryDollar offer free versions, but the premium features differentiate them significantly. Goodbudget’s premium tier enhances envelope management, while EveryDollar focuses on automation for effortless tracking. The decision ultimately hinges on whether a user prefers a hands-on approach to budgeting or values the efficiency of automated tracking.

| App | Free Version Features | Premium Version Features |

|---|---|---|

| Goodbudget | Limited envelopes, manual tracking | Unlimited envelopes, multi-device sync, advanced features |

| EveryDollar | Basic budgeting tools | Automatic transaction syncing, premium support, enhanced features |

In conclusion, both Goodbudget and EveryDollar present compelling pricing models that cater to different financial management styles. While Goodbudget appeals to those who appreciate a structured envelope system, EveryDollar attracts users looking for a hassle-free, automated approach. Assessing personal budgeting preferences will ultimately guide individuals in selecting the app that best suits their financial journey.

Pros and Cons of Each App

As users delve into the world of budgeting apps, understanding the pros and cons of each platform is essential for making an informed decision. Both Goodbudget and EveryDollar present unique benefits and challenges that cater to different financial management styles. This section will explore the strengths and weaknesses of each app, allowing potential users to assess which tool aligns best with their budgeting needs.

Goodbudget stands out for several reasons, offering a robust envelope budgeting experience that appeals to individuals seeking structure and control over their finances.

- Visual Budgeting: The envelope system provides a clear visual representation of where money is allocated, making it easier to stay on track.

- Manual Tracking Encouragement: By requiring manual entry, users often develop a deeper understanding of their spending habits.

- Flexibility in Envelope Management: Users can create multiple envelopes, allowing for detailed categorization and goal setting.

- Web and Mobile Access: The app is available on various platforms, ensuring accessibility whether at home or on the go.

While Goodbudget offers several appealing features, it is not without its limitations, which may affect some users’ experiences.

- Manual Input Required: The need for manual transaction entry can be time-consuming and may deter those who prefer automation.

- Limited Free Features: The free version restricts the number of envelopes, potentially hindering users with diverse budgeting needs.

- Lack of Automatic Syncing: Unlike some competitors, Goodbudget does not offer automatic syncing with bank accounts in its free version, which may lead to discrepancies in tracking.

EveryDollar’s user-friendly design and focus on zero-based budgeting provide a compelling alternative for those looking for efficiency in their financial management.

- Simplicity and Speed: Users can set up a budget quickly, making it ideal for those with busy schedules.

- Automatic Transaction Syncing: The premium version allows for real-time updates by syncing with bank accounts, minimizing the need for manual entries.

- Comprehensive Budgeting Framework: EveryDollar ensures that each dollar is assigned a purpose, promoting financial discipline and clarity.

- Intuitive Interface: The minimalist design enhances the user experience, making navigation straightforward and efficient.

Despite its many advantages, EveryDollar also has certain drawbacks that potential users should consider before committing to the app.

- Premium Features Behind a Paywall: Access to automatic syncing and other advanced features requires a subscription, which may not appeal to budget-conscious users.

- Less Focus on Visual Management: Users who prefer a visual representation of their finances may find EveryDollar’s approach lacking compared to Goodbudget.

- Limited Free Functionality: The free version provides basic budgeting tools but may not suffice for users who want a more comprehensive experience.

In summary, both Goodbudget and EveryDollar present distinct advantages and challenges that can significantly impact user experience. Individuals should weigh these pros and cons against their financial goals and personal preferences to determine which app will best support their budgeting journey.

Disclaimer

This article has been created or edited with the support of artificial intelligence and is for informational purposes only. The information provided should not be considered investment advice. Please seek the support of a professional advisor before making any investment decisions.