Identifying Legitimate Credit Repair Services

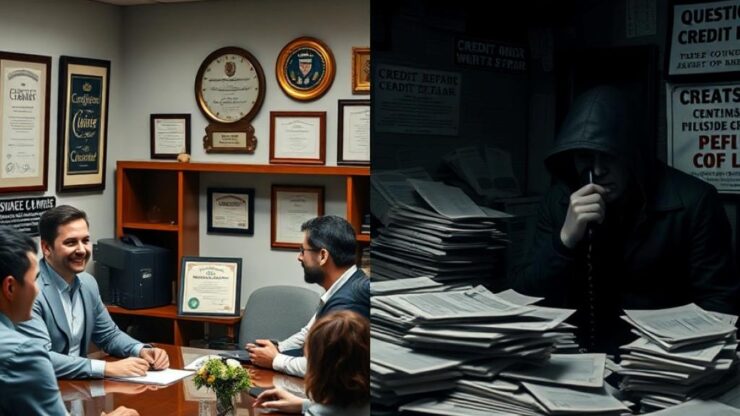

In a world where financial literacy is increasingly important, understanding the difference between legitimate credit repair services and unscrupulous scams is crucial. With the rise of consumer debt and the complexities of credit scoring, many individuals seek assistance to improve their credit profiles. However, the credit repair industry is rife with both reputable businesses and fraudulent operations looking to exploit vulnerable consumers. This guide aims to equip you with the knowledge necessary to identify legitimate services that can truly help you.

When evaluating credit repair companies, it’s essential to look for specific characteristics that distinguish genuine services from scams. Legitimate credit repair companies operate transparently and prioritize client education. They provide a clear outline of their services, fees, and processes. Here are some key traits to consider:

- Transparency: Authentic companies disclose their fees upfront and provide a written contract outlining their services.

- Education: They empower clients with knowledge about credit scores and the factors affecting them.

- Realistic Promises: Legitimate services do not guarantee specific results but rather educate consumers about improving their credit scores over time.

- Compliance with Laws: They adhere to the Credit Repair Organizations Act (CROA) and other relevant regulations.

While legitimate credit repair companies exist, it’s equally important to be aware of the common red flags that indicate a potential scam. By recognizing these warning signs, consumers can protect themselves from financial harm. Below is a list of red flags to consider:

- Upfront Fees: Be cautious of companies that demand payment before services are rendered.

- Vague Guarantees: Avoid companies that promise to remove negative information from your credit report, as this is often not possible.

- Pressure Tactics: Scammers may pressure you into signing contracts or making quick decisions.

- Lack of Contact Information: Legitimate companies provide clear contact details and a physical address.

By keeping these traits and red flags in mind, consumers can make informed decisions when selecting a credit repair service. Remember that the goal is not just to remove negative items from your credit report but to foster long-term financial health.

Common Red Flags of Scam Credit Repair Companies

As consumers navigate the often murky waters of credit repair, it becomes increasingly vital to recognize the telltale signs of companies that lack integrity and ethical standards. Understanding these warning signs can save you not only your hard-earned money but also significant emotional stress. This section will illuminate the common red flags associated with scam credit repair companies, helping you make informed decisions before entering into any contracts.

One of the first indicators that a credit repair company may not be legitimate is its marketing approach. Scammers often rely on misleading advertisements that promise quick fixes for credit issues, often using phrases like “guaranteed results” or “we can erase bad credit.” These claims are not only unrealistic but also often illegal. Reputable companies understand that credit repair is a process and cannot guarantee specific outcomes. Instead, they focus on educating clients about their credit profiles and the time it takes to see improvements.

A legitimate credit repair service will prioritize open communication and client involvement throughout the process. Beware of companies that isolate you or provide minimal information regarding your credit repair journey. A common tactic among scammers is to take control of your situation without your active participation, leaving you in the dark about what actions are being taken on your behalf. This lack of transparency is concerning, as it prevents you from understanding how your credit profile is being managed and what steps you can take to improve it.

Trustworthy credit repair companies always offer a detailed written contract outlining their services, fees, and the rights of the consumer. If a company hesitates to provide this documentation or offers only vague verbal agreements, it should raise serious concerns. Scammers often avoid written contracts to evade accountability and to manipulate clients into paying for services they may never deliver. A clear, well-defined contract is not only a legal requirement but also a sign of a company that respects its clients and operates ethically.

Understanding Your Rights in Credit Repair

When engaging with credit repair services, understanding your rights is paramount. This knowledge not only empowers you to make informed decisions but also safeguards you against potential exploitation by unscrupulous operators. As a consumer, you have specific rights under the Credit Repair Organizations Act (CROA), which aims to protect individuals seeking assistance with their credit profiles. Familiarizing yourself with these rights can help you navigate the credit repair landscape with confidence.

Under the CROA, consumers are entitled to a series of protections that ensure fair practices in the credit repair industry. One of your fundamental rights is the right to receive a written contract prior to any services being rendered. This contract must clearly outline the services provided, the time frame for these services, and the total cost involved. It is crucial that you carefully review this document to ensure you are not agreeing to vague terms that could lead to disputes later on.

Additionally, you have the right to cancel any contract within three business days of signing without incurring any penalties. This cooling-off period allows you to reconsider your decision and seek alternative options if necessary. Remember, legitimate companies will always honor this right, whereas scam operators may pressure you to continue with their services.

Another essential aspect of your rights in credit repair is the assurance of transparency regarding the actions taken on your behalf. You have the right to be informed about the steps being undertaken to improve your credit score. A reputable company will keep you updated and provide you with copies of any correspondence sent to credit bureaus. If you find yourself in a situation where a credit repair service is secretive about its processes or fails to provide timely updates, it is a significant red flag. Accountability is a cornerstone of legitimate credit repair, and you should feel empowered to ask questions and demand clarity at any stage of the process.

In conclusion, understanding your rights in credit repair not only protects you from fraudulent practices but also enables you to engage more effectively with legitimate services. By asserting your rights to transparency, written agreements, and the ability to cancel without penalty, you position yourself as an informed consumer ready to take control of your financial future.

The Cost of Credit Repair: What to Expect

When considering credit repair services, one of the most pressing concerns for consumers is understanding the cost involved. Unlike traditional services with clear pricing structures, the credit repair industry can be somewhat opaque when it comes to fees, making it imperative for individuals to grasp what they can expect financially. The cost can vary significantly based on the company, the complexity of the client’s credit issues, and the specific services offered. This section aims to shed light on the typical expenses associated with credit repair, ensuring consumers are well-informed before making a commitment.

Legitimate credit repair services often utilize a fee structure that reflects the complexity of the work involved. Generally, you can expect to encounter two primary types of fees: setup fees and monthly maintenance fees. Setup fees are typically charged upfront to initiate your account, covering the initial analysis of your credit report and the development of a personalized action plan. These fees can range from a modest amount to several hundred dollars, depending on the reputation and effectiveness of the service provider.

Once you are enrolled, monthly fees will apply for the ongoing services rendered. On average, these fees can fluctuate between $50 to $150 per month, contingent on the breadth of services provided. It’s crucial to recognize that while lower fees may appear attractive, they can often indicate inferior service or a lack of transparency. In contrast, higher fees do not automatically equate to high-quality service; thus, it’s vital to evaluate the value you are receiving in relation to the cost.

While legitimate credit repair companies operate with transparency regarding their fees, scam operations often employ deceptive tactics to lure customers in with promises of low costs and quick fixes. Consumers should be wary of companies that demand substantial upfront payments without a clear outline of services provided. Such practices are often indicative of a scam, aiming to capitalize on the desperation of individuals seeking credit improvement.

Moreover, it is essential to critically assess the scope of services included in the quoted fees. Some companies may engage in unethical practices or hidden charges that can lead to unexpected financial burdens. For instance, a legitimate service will provide a comprehensive breakdown of any additional costs that may arise during the process, such as fees for dispute letters or additional consultations. Understanding the full scope of what you are paying for allows you to avoid falling victim to hidden fees that can erode your financial stability.

How to Research and Choose a Reputable Credit Repair Agency

In the quest for financial stability, the selection of a trustworthy credit repair agency can significantly influence the outcomes of your credit journey. With an abundance of options available, consumers must take a diligent approach in researching and evaluating potential agencies. The following strategies will equip you with the tools necessary to discern reputable services from dubious ones.

Before engaging with any credit repair agency, it is paramount to conduct thorough research into their background. Start by examining their reputation through various online platforms. Look for reviews on trusted websites such as the Better Business Bureau (BBB) or consumer advocacy groups. These platforms provide insights into the agency’s track record, customer satisfaction, and any complaints filed against them.

Additionally, explore social media channels and forums where previous clients may share their experiences. This qualitative data can offer valuable perspectives that are not always captured in formal reviews. Furthermore, ensure that the agency has been in business for a significant period, as longevity can often indicate reliability and experience in the field.

Once you have shortlisted potential agencies, assess their level of transparency regarding their services and fees. A reputable credit repair company should provide a comprehensive breakdown of their offerings, detailing what services are included and the associated costs. Look for the following elements:

- Written Contracts: Ensure the agency offers a clear, written contract that outlines all terms and conditions.

- No Hidden Fees: Be wary of agencies that do not openly disclose their fee structure or those that demand payment upfront without delivering detailed service descriptions.

- Client Education: Legitimate agencies prioritize educating their clients about credit scores and improvement strategies.

By evaluating these factors, you can gain confidence in the agency’s integrity and commitment to client welfare.

Lastly, don’t hesitate to ask the credit repair agency for references from previous clients. A credible agency will be willing to share testimonials and contact information for individuals who have successfully improved their credit scores with their assistance. Speaking directly with these references can provide firsthand insights into the agency’s effectiveness and customer service.

Additionally, consider consulting with a financial advisor or credit counselor who can offer unbiased advice regarding your choice of agency. Their expertise can help you navigate the complexities of credit repair and ensure that you are making a sound decision.

By actively engaging in research and employing these strategies, consumers can confidently select a reputable credit repair agency that aligns with their financial goals and needs.

Disclaimer

This article has been created or edited with the support of artificial intelligence and is for informational purposes only. The information provided should not be considered investment advice. Please seek the support of a professional advisor before making any investment decisions.