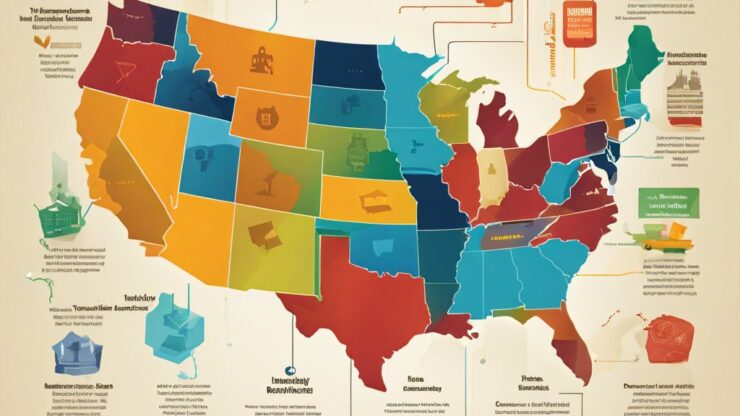

In an increasingly mobile society, understanding state residency and its implications on income taxes has become crucial for many individuals. As people move between states for work, education, or personal reasons, they may not realize that their residency status can have significant tax consequences. This article delves into the complexities of multi-state residency issues and aims to provide a clearer understanding of how different states approach taxation for their residents.

Determining Residency: The Key Factors

Residency is not merely about where one sleeps at night; it encompasses a variety of factors that can influence state tax obligations. Each state has its own criteria for determining residency, and this can lead to confusion and, in some cases, double taxation. Here are some key factors that states typically consider:

- Physical Presence: The number of days spent in a state can be a determining factor.

- Intent: Evidence of an intention to remain in a state, such as obtaining a driver’s license or registering to vote.

- Financial Connections: Where you maintain bank accounts, business interests, and property can influence residency status.

Navigating Multi-State Tax Obligations

For individuals who find themselves working in one state while living in another, navigating multi-state tax obligations can be a daunting task. Understanding how to report income and which state to pay taxes to is essential to avoid penalties. States often have reciprocal agreements, which can simplify tax obligations, but these agreements vary significantly. Below is a comparison of key concepts:

| State | Reciprocal Agreements | Tax Rate |

|---|---|---|

| California | No | 9.3% – 13.3% |

| New York | Yes (NJ, PA) | 4% – 8.82% |

| Illinois | No | 4.95% |

It’s vital to stay informed about the tax laws in both states, as failing to comply can result in unexpected liabilities. Consultation with a tax professional familiar with multi-state issues is often recommended to navigate these complexities effectively.

Disclaimer

This article has been created or edited with the support of artificial intelligence and is for informational purposes only. The information provided should not be considered investment advice. Please seek the support of a professional advisor before making any investment decisions.